What is a distribution account in quickbooks?

Distribution Account for a transaction in QuickBooks refers to a particular account / accounts specified on the bottom part of a form. Take for instance, if you have created an expense transaction, the distribution account would be the Expense account that you used to track the amount of the account .

Also asked, what type of account is a distribution?

Distribution Accounts

A distribution account represents the activity of distributions made during the month. This may include equity payments to shareholders or dividends to stockholders. Distribution accounts close to the retained earnings account.

Beside above, are Distributions an expense? Cash or stock dividends distributed to shareholders are not recorded as an expense on a company’s income statement. Stock and cash dividends do not affect a company’s net income or profit.

In this way, what type of account is owner distribution in QuickBooks?

equity

What is owner distribution in accounting?

A distribution to owners is a payment of the retained earnings of a business to its owners . This distribution results in a reduction of the equity and assets of the business. The distribution is usually made in cash, though it can also be made using any other asset of the business.

What is the theory of distribution?

The theory of distribution is that incomes are earned in the production of goods and services and that the value of the productive factor reflects its contribution to the total product.

What is a distribution in accounting?

Accounting distributions are used to define how an amount will be accounted for, such as how the expense, tax, or charges will be accounted for on a vendor invoice. Every amount that must be accounted for when the vendor invoice is journalized will have one or more accounting distributions .

What are different types of distributions?

There are many different classifications of probability distributions . Some of them include the normal distribution , chi square distribution , binomial distribution , and Poisson distribution . The different probability distributions serve different purposes and represent different data generation processes.

What is the difference between contribution and distribution?

A contribution is an amount of money that you deposit into your HSA. A distribution is a withdrawal of funds from your HSA.

Is owner distribution an expense?

An owner’s distribution is not an expense to the llc or income to the owner . Rather, the owner is taxed on the llc’s income and expenses before any distribution of profits .

What is a distribution rate?

In general, a distribution rate is calculated by annualizing the most recent amount paid to investors and dividing the resulting amount by either the market price or the fund’s NAV. A mutual fund’s yield shows its interest and dividend income expressed as a percentage of the fund’s current share price.

Is distribution a debit or credit account?

Cash Distributions Effect on Equity

The journal entries made with the declaration of dividends include a debit to the retained-earnings account and a credit to the dividend-payable account . When the company actually pays the dividends to shareholders, the dividends-payable account is debited and cash is credited .

How do you account for owners draw?

To record owner’s draws , you need to go to your Owner’s Equity Account on your balance sheet. Record your owner’s draw by debiting your Owner’s Draw Account and crediting your Cash Account .

Is owner distribution an equity account?

Partnership Equity Accounts

This account has a credit balance and increases equity . Owner’s Distributions – Owner’s distributions or owner’s draw accounts show the amount of money the owner’s have taken out of the business. Distributions signify a reduction of company assets and company equity .

How does owner’s draw affect the balance sheet?

The owner’s drawings will affect the company’s balance sheet by decreasing the asset that is withdrawn and by the decrease in owner’s equity . (If an asset other than cash is withdrawn, it is reported as supplemental information on the statement of cash flows.)

What is a draw account?

A drawing account is an accounting record maintained to track money withdrawn from a business by its owners. A drawing account is used primarily for businesses that are taxed as sole proprietorships or partnerships.

Do distributions reduce net income?

Cash distributions reduce the company’s net worth and are typically subtracted from retained earnings . Retained earnings are the cumulative net income from prior periods. Profits your company retains become part of owners equity on the balance sheet.

What goes into retained earnings?

Retained earnings (RE) is the amount of net income left over for the business after it has paid out dividends to its shareholders. A business generates earnings that can be positive (profits) or negative (losses). The money not paid to shareholders counts as retained earnings .

What kind of account is owner draw?

owner’s drawing account definition. The contra owner’s equity account used to record the current year’s withdrawals of business assets by the sole proprietor for personal use. This is a temporary account with a debit balance. It will be closed at the end of the year to the owner’s capital account.

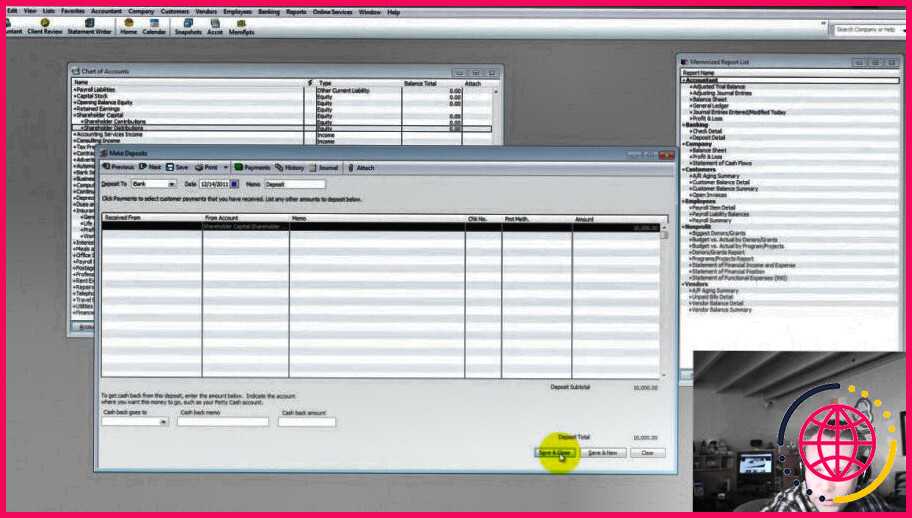

What is the journal entry for distribution?

There is no Journal Entry for taking a distribution . That is already what you would enter on the Check or Banking Transaction that pays you the amount. After year end entries from tax preparation are done, the Retained Earnings has the final amount.

Does an LLC have paid in capital?

Members of an LLC are subject to capital contributions, i.e. the amount of money or assets given to the business by one of the members, and profit distributions based on terms they agree to in the Operating Agreement.

How does QuickBooks organize chart of accounts?

Go to https://help. quickbooks .intuit.com/en_US/contact. At the top right, select your QuickBooks version. Select a topic.

Here’s how:

- At the top menu, select Lists.

- Select Chart of Accounts.

- Highlight the account you want to move.

- Using the left mouse button, press and hold the account and drag it to the desired place.